Why the Hidden Champion concept works much better for healthcare companies than any accelerator program

A major component of digitization strategies of companies in the healthcare sector is to connect with start-up companies. This created a hype around start-up matching programs for the healthcare industry. Incubators, accelerators, hackathon events or investment funds have emerged that organize matching of start-up with traditional healthcare companies.

Start-up companies mainly benefit from those programs in an increase of awareness, a challenging of the business model, some money and access to distribution channels. Programs mainly attract early stage start-ups that are in concept phase or just launched their initial service offering. 95% of which will fail (mHealth Economics 2015).

The value the established companies get out of these programs seems to be more on the cultural change and educational side rather than on the business side. Only a few companies like Bayer have set up their own start-up programs. Those programs allow at least to search and select the start-up companies based on a company specific search catalog. Still start-ups that are being attracted by those programs are far away from success and the 95% failure rule applies to them as well. Most other programs like Start Up Boot Camp present their corporate partners a rather broad spectrum of start-ups that might have an interesting business model or an innovative technology but the chances for linking it with the core business of the companies are limited in most cases.

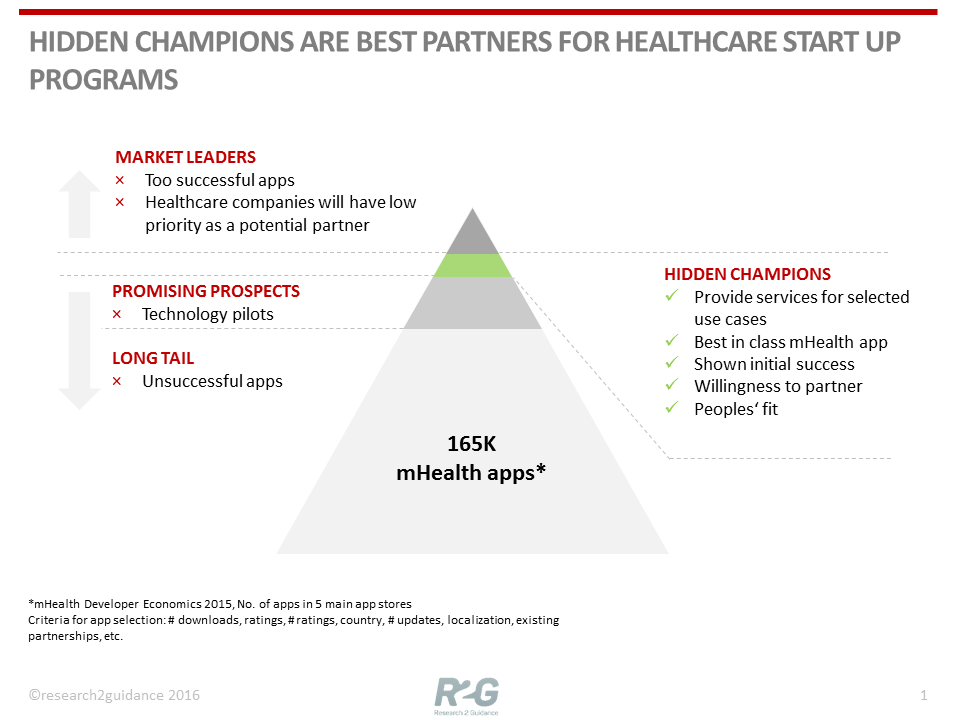

In order to get more out of the collaboration with start-ups, healthcare companies should change their approach. First of all they should concentrate on “hidden champions” rather looking at dozens or even hundreds of tech studies and early stage mHealth app services.

Healthcare start-up programs should be build around five dimensions.

- From pre selection to specific search, meaning don’t “eat” from a given menu of pre-selected start-ups rather create a specific app portfolio. Company requirements are too specific to greatly benefit from a pre selection of start-ups presented by the program managers to pharma, health insurance and med tech companies

- From investment to partner models, meaning that true value for a health care companies comes from linking the mobile channel (via app) with its core business. Owning and developing exit strategies like a VC is not their core business and slows integration process down. Companies should rather develop partner models that allows start-ups to link their services to the current service offering or processes. Become the “first customer” partner models allow more flexibility and promises better results.

- From culture change to business focus meaning that the ambition should be set higher for participation in those start-up programs. Even though the value of mixing unconventional ideas and people with own thinking and current staff is of great value, ambition should be higher. Currently mHealth app solutions and business models have reached a sophistication level that allows to shift the focus to “making money”, “reducing cost” or “knowing customers better”.

- From early stage start-ups to hidden champions meaning that companies should minimize the risk of betting on the “wrong horse” by systematically searching for companies that have shown initial success in user acceptance but are not already too big to be willing and flexible enough to enter into a real partnership. Hidden Champions represent around 3%-5% of the mHealth app market. They exist for the majority of mHealth use case like Diabetes, pregnancy, Asthma, remote diagnosis to name just a few.

- From adhoc screening to ongoing partnering and integration, meaning that participating in a yearly matching program or organizing occasional start-up events is not enough to create impact and to establish a digital healthcare business with the help of third party apps. Healthcare companies should set up an ongoing process that starts with mobile use case identification and screening, manages the integration of the appcos service offerings and constantly measures the success of the integration and digitization.

The number of mobile use cases that a health insurance, a pharmaceutical or a med-tech company could potentially want to integrate into their core business is large. Companies should develop end to end processes that does not stop at identification of interesting concepts but rather developing duplicable partner models and integration processes.

Reach out to us, if you want to learn more about the r2g app portfolio screening and integration approach. As always feedback is highly appreciated.