The 3 phases of the diabetes app market development and why publishers continue to struggle

The diabetes app market has long been the go-to of mobile health app developers, but the uptake among People With Diabetes (PWDs) only recently showed some traction. The reasons for the low success rates can be explained through the 3 diabetes app concept development stages: apps as stand-alone tools, apps as diabetes device add-ons, and as integrated personalized care platforms. PWDs are generally underwhelmed with the limited functionality of the apps, and the lack of integration and data interoperability on the market. Today, device integration partnerships between device manufacturers and digital diabetes care platform providers have emerged and show a great promise to improve the current market status.

According to the 2016 mHealth App Developer Economics study, 73% of mobile health app developers believe that diabetes is the therapy field which holds the highest market potential. In 2016, the addressable target group- diagnosed people with diabetes (PWDs) who own a smartphone- reached 135.5M people globally. The competition among publishers has been growing for the past 8 years, since the Apple App Store launched. In 2016, the number of diabetes care apps on the Apple App Store and Google Play Store reached nearly 1,800. Nevertheless, these publishers are yet to achieve major success- only 3.3% of the addressable target group have become monthly active app users in 2016. Though this percentage has grown significantly from 2.2% in 2014, publishers have not yet achieved a breakthrough despite the great hopes and promises. So, what are the reasons behind it?

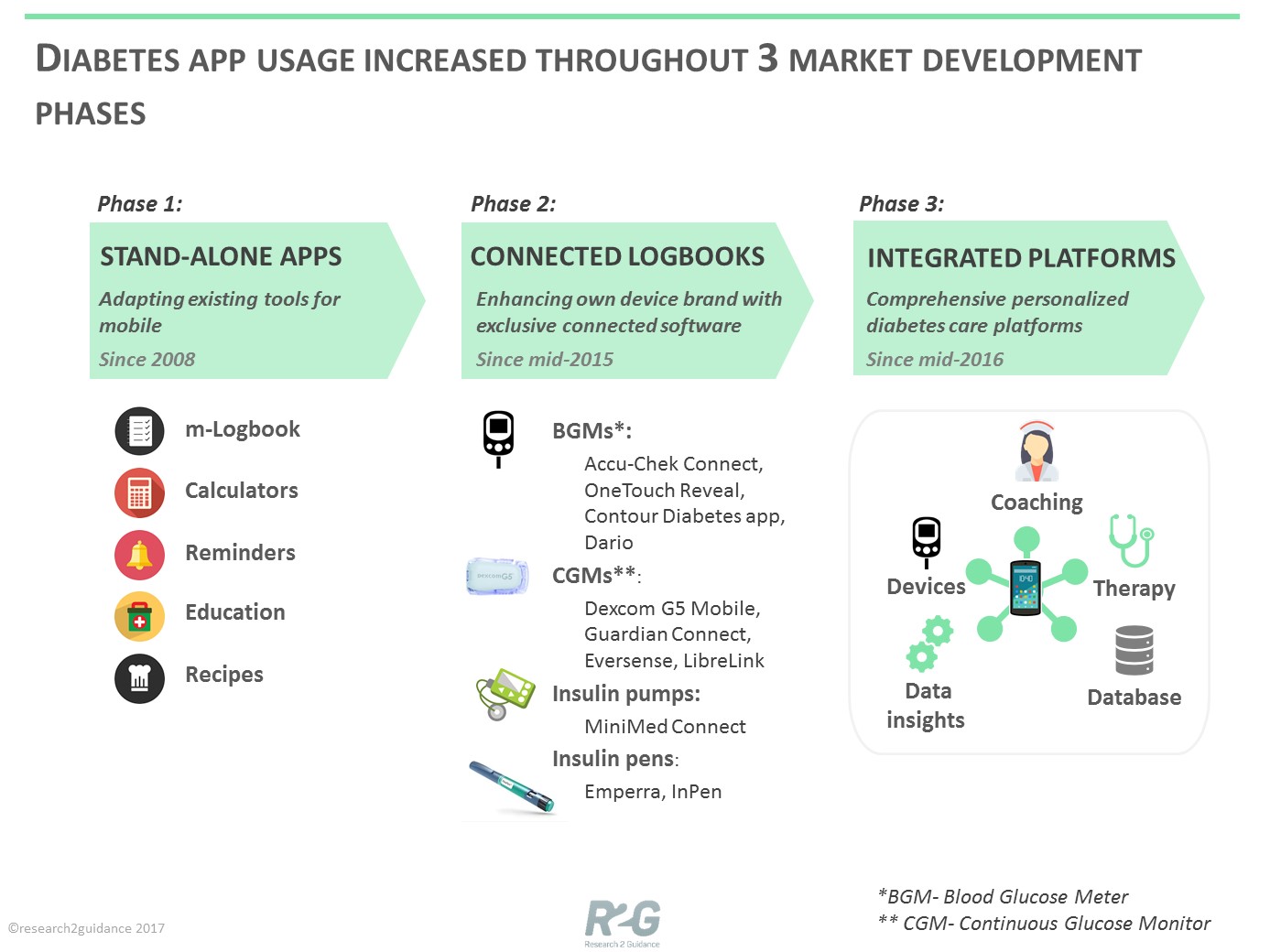

The market developed in 3 phases, during which publishers introduced multiple app use cases to PWDs, but limited functionality and a lack of data interoperability left PWDs underwhelmed.

Phase 1: Make existing diabetes care tools mobile

During the early years of the Apple App Store, the diabetes app market segment was dominated by manual logbooks, reminders, education tools, basic calculators and nutritional reference apps. Small developers were hoping to generate some revenues via paid downloads or in-app purchases, meanwhile established diabetes care market players were hoping to improve brand awareness. However, these tools did not impress PWDs as they were not new- just a mobile-adapted version of an already existing tool that required high user effort. Poor and limited app functionality lead to low app usage as the early apps failed to provide a sustained business. Many of these apps are still available on the app stores today but were abandoned years ago. Consequently, in 2016 only around 35% of diabetes apps were actively managed.

Phase 2: Enhance diabetes devices with exclusive digital services

Mid-2015 marked a great shift in the market: multiple major diabetes device vendors started releasing smartphone connected product lines and started building their own closed connected ecosystems. Eventually Roche, Dexcom, Medtronic, J&J, Abbott (with Freestyle Libre) and Ascensia all started building their own connected mobile ecosystems to enhance the device user experience by offering unique software tools built exclusively for their brand. The apps offered features such as automatic logbooks, reporting tools for clinical visits, pattern recognition features to generate insights into patient data and insulin calculators.

However, PWDs were not impressed with these ecosystems. While they gladly met the new standard of the app connected devices, the connected apps offered very limited functionality due to publishers facing regulatory burdens. Users soon pointed out that device vendors were behind the start-up like patient care software companies when it came to their in-app feature and functionality offering. The connected apps faced poor reviews, with average user ratings ranging between 2.5 and 3.5 stars. Users were underwhelmed by the limited functionalities in comparison to market leading diabetes care apps such as mySugr, One Drop or Glooko that were rated well above 4 stars by the users. Users expressed a clear preference for 3rd party ecosystems, and started demanding convenient data access.

Phase 3: Integrate diabetes data with the best-in-class diabetes care platforms

Today, companies have finally realized that they cannot develop tools independently; partnerships around data and knowledge exchange, as well as device integration have become a must-have digital diabetes care strategy. It is becoming a common practise to integrate your diabetes device data with industry leading mobile diabetes platforms. Such platforms offer patient services such as insights into retrospective patient data, personalized coaching and prescribed therapy support. For example, OneTouch Reveal, Accu-Chek Connect, Dexcom’s G5 Mobile device data can be exported via Apple HealthKit API to mobile platforms such as mySugr, One Drop or Glooko for patient or HCP use. Despite having their own connected app, Roche’s Accu-Chek Aviva Connect meter allows users to directly export data to mySugr Logbook. OneTouch brand meters just recently became integrated with WellDoc’s BlueStar app. European LibreLink users have the option to access their data on mySugr, Social Diabetes and Diasend platforms. Glooko has recently signed Medtronic and Ascensia as a partner for app data integration via API (amongst 40+ other diabetes devices). In the next few years we should expect the number of industry partnerships around device integration to the care platforms to grow.

But key device manufacturers do not stop at just providing data. They want to become stakeholders of digital diabetes care platforms to avoid having to build these tools in-house. Industry partnerships around digital care tool R&D are just starting to emerge:

- Sanofi has joined forces with Verily in a joint Onduo project to co-develop tools for T2D management

- Novo Nordisk has teamed up with Glooko to co-develop digital health solutions including mobile insulin dosing system- in app insulin dosage calculator that can be adjusted remotely by HCP

- Medtronic has worked with IBM Watson and Glooko to develop AI powered Sugar.IQ app

After 8 years of change, the market is now expected to show signs of improvement, as key players team up to improve the digital diabetes care platforms. Their joint service offering will consist of connected devices, retrospective data insights, coaching, prescribed mobile therapy, remote monitoring and databases. They will be engaging PWDs, healthcare professionals and payor organisations. If executed correctly, such platforms show high promise to drive the usage of diabetes care apps in the next few years. Nevertheless, only few of the publishers follow this strategy, while app stores remain cluttered with apps with limited functionality that are often unmanaged. Publishers continue to add new apps, simply copying predecessors and creating further obstacles for the publishers to come.

Want to get more details about the key trends and the industry leaders in the diabetes app market? Check out our Digital Diabetes Care Market 2018-2022: Ready To Take Off Report.

Want to be up to speed with the latest developments in this ever changing mobile health market segment? Ask us about diabetes app market monitoring: [email protected]

Patients probably desire just two things that spell AUTOMATION (in order to be free from the monitoring hustle):

1. Continuous monitoring

2. Early alert (not databases, God forbid)

I can help with the second one.

Edith

Home of GT data mining