Why Health Insurance companies fail to generate significant reach with their app portfolio

The majority of health insurance companies can be described as hesitant in their app publishing activities, even those that have a larger app portfolio fail to have a significant impact. Some reasons are that health insurance companies are not leveraging their assets, their apps are not compliant with state-of-the-art app publishing rules and missing cross promotion.

These are just some of the findings from our Health Insurance App Benchmarking Report 2015.

The vast majority of health insurance companies have failed to generate a significant reach with their app portfolio, with 67% of health insurance companies having achieved less than 100,000 downloads. The majority of apps in the portfolio of healthcare payers belong to the long-tail.

70% of health insurance companies can be described as hesitant publishing only 1 or 2 apps. However, if health insurance companies were to publish more apps they wouldn’t necessarily generate higher download numbers.

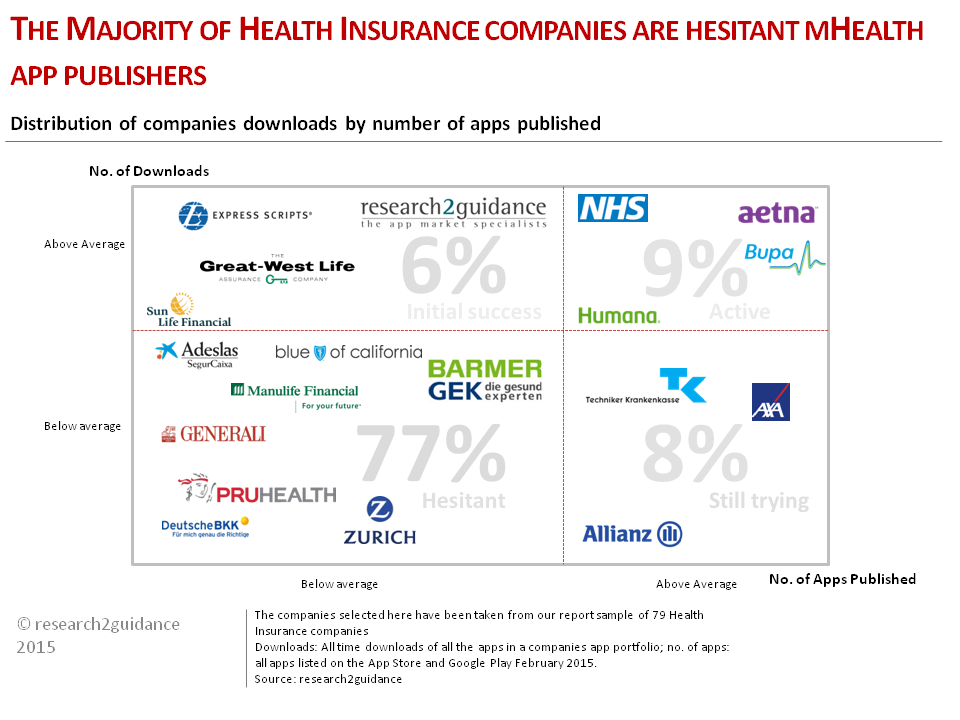

77% of health insurance companies belong to the low impact category having published less than average apps with less than average download numbers. Only 9% of health insurance app publishers could be described as active with above average impact.

Aetna is the one health insurance company that stands out. Having published 28 apps across both iOS and Android Aetna have achieved more than 14million downloads, significantly more than any other health insurance company. That being said 85% of those download come from just on app within their app portfolio, iTriage. This is not uncommon amongst those health insurance companies that have generated a large number of downloads. For example, 7 of the top 10 biggest health insurance companies[*] app portfolios generate more than 50% of downloads from the top performing app.

What are the reasons for the little impact the traditional payers of the healthcare systems have in the app economy? The study results indicates that:

- Most health insurance companies fail to produce ‘state of the art’ apps — Apps in most cases do not incorporate the 6 key elements of best practice: Tracking and coaching, automated input, remote consultation, secure use of mHealth data, integrating their solutions into the current IT healthcare infrastructure and beautiful design and usability.

- Companies fail to realize the potential of app integrated incentive schemes — Health insurance companies are best positioned to link financial rewards via incentive schemes to healthy and cost saving behavior of their members. However, currently there are only a few companies that link healthy behavior to financial rewards with the help of an app.

- Health insurance companies fail to successfully cross-promote their app portfolio — Companies do not successfully leverage their app portfolio through cross-promotion. Best practise mHealth app publishers manage to have almost equally successful apps in their portfolio by cross promotion using for example, “more apps” screens, pop-ups and push notifications. This is not being done at all by health insurance companies.

These are just some of the findings from our report, for a more detailed analysis of some of the world’s top health insurance companies and their mHealth app publishing activities check out our new 2015 Health Insurance App Benchmarking report.

Comments are as always welcome.

[*] The top 10 health insurance companies refer to the health insurance companies from our sample that have generated the highest number of all time global downloads

The mHealth Economics 2017 Report is out.

Download the report for free!