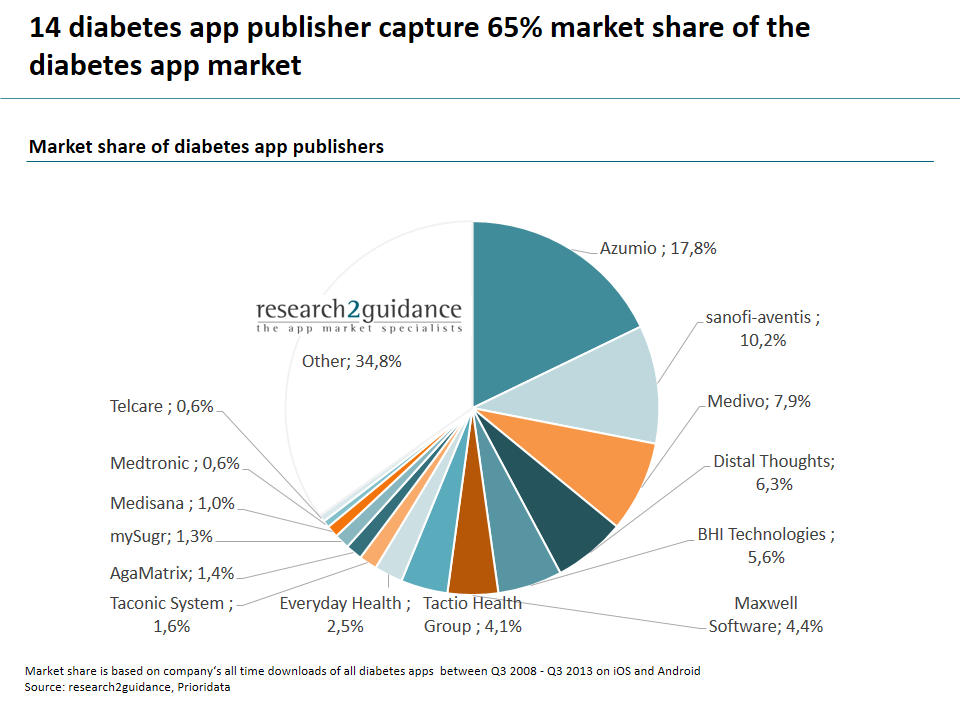

Top 14 diabetes app publishers capture 65% market share of the diabetes app market

65% of all downloads in the diabetes app market are generated by only 14 app publishers. Most of the top publishers are small app developers. The competitive landscape is still fragile.

Market players and market shares

With the exception of sanofi-aventis, Metronic and Medisana most successful diabetes app publishers are small technology companies. Some of them have produced medical devices for diabetes tracking, but most of them have started their business with the upcoming of the app market after 2008 as pure app developers. A significant number of diabetes app publishers, not only those in the top 14, developed their solution based on their personal experience with the disease. For most of the top players the initial motivation to publish a diabetes app was to make life easier for themselves, relatives or friends — developing a products only came second.

The competitive landscape in the diabetes app market is still very fragile. According to the new report “Diabetes App Market 2014”, the ranking of the top 14 diabetes app publishers are not carved in stone. The overall quality, total download and user numbers are not high enough to prevent new innovators complying with the best practice standards for diabetes app publishing and a good marketing strategy to turn the market upside down.

The market share is measured in lifetime downloads of all diabetes apps published by one company of total downloads.

Today Azumio, a venture-backed mHealth app specialist from San Francisco, is the market leader with almost 18% market share. Azumio has published two diabetes apps: Glucose Buddy and Blood Sugar Tracker.

Healthcare giant sanofi aventis comes in on second position with 10% market share. sanofi aventis established its market position based on two main diabetes apps: GoMeals and iBGStar.

There are three diabetes app publishers with a market share above 5%: Medivo, Distal Thoughts and BHI Technologies. All other market players have a market share of less than 5%.

Top diabetes app publishers on average concentrate on one mobile use case, which they implement as a free and as a paid version for Android and iOS. Only a few app publishers support 2 or 3 different uses cases.

The mobile diabetes market

Diabetes is a global epidemic with a significant impact on the society and economy. In 2013 around 8.3% (382M) of the global population was estimated to suffer from diabetes. By 2030 this already high number of diabetes patients is expected to double.

Mobile health solutions are expected to be able to help delivering solutions for diabetes patients; especially by empowering them to better manage their condition and thus reduce healthcare costs. Mobile diabetes apps are able to make diabetes patients’ lives easier by supporting behaviour changes, facilitating communication and help track all relevant diabetes parameters. Diabetes is the therapeutic area with the highest business potential for mHealth apps — named by 76% of mHealth app publishers in research2guidance’s yearly mobile health surveys.

Currently there are more than 1,100 iOS and Android specific diabetes apps available on the Apple App Store and Google Play. These apps either target diabetes patients or healthcare professionals who treat diabetes patients.

Addressable market today and in 5 years time

Mobile diabetes apps are currently only used by 1.2% of the target group. Although the market penetration will grow to 7.8% by 2018, the market potential is not yet exhausted. The main reason for the low usage is based on a comparatively low sophistication level of diabetes apps as compared with the status quo of today’s mobile apps.

Over the course of the next five years the market environment for diabetes apps will improve. The usage of diabetes apps within the addressable market will reach 7.8% in 2018. (Addressable market is defined as diabetics owning a smartphone or tablet). 24 million people will actively use diabetes apps to manage their health condition in 2018.

The main factors driving penetration rate of diabetes apps up are:

– A steadily growing number of people with diabetes who will be reachable via a mobile app.

– Diabetes apps will develop from a stand-alone product to a bundle product. Thus the mobile app will be a tool to sell devices like plug-in glucometers/ wearable sensors, or services like remote monitoring/ consultation.

– With an increasing number of diabetes apps the quality level will raise. Diabetes apps will adopt best practices from other app models.

– With app costs being reimbursed by traditional payers in countries with high yearly treatment costs for a diabetic patient competition among app publishers will increase.

– During the next five years the diabetes app market will raise to a new level. Chances for a major market breakthrough have improved.

Additional information is in the research2guidance “Diabetes App Market 2014, How to leverage the full potential of the diabetes app market”. The report is available on research2guidance website. See “Diabetes App Market 2014“.

We welcome your feedback on the competitive landscape in the diabetes app market.

The mHealth Economics 2017 Report is out.

Download the report for free!