Health Insurance Companies must re-think their app publishing approach if they are to succeed in the mHealth app economy

“If HICs do not rethink their approach to mHealth app publishing, they are likely to remain an industry player with a low impact on the mHealth app market. Continuing in this fashion is not currently a serious threat to HICs’ core business. But in the next 5 years it will be.”

These are just some of the findings from our Health Insurance App Benchmarking Report 2015

After 5-6 years of app publishing Health Insurance Companies have failed to have a significant impact on the mHealth app market. Furthermore they are competing with those mHealth companies that have aggressively positioned themselves within the market. Therefore HICs must rethink their app publishing approach if they are to have any success. If they don’t, they run the risk of growing their app portfolio whilst failing to reach a significant number of users.

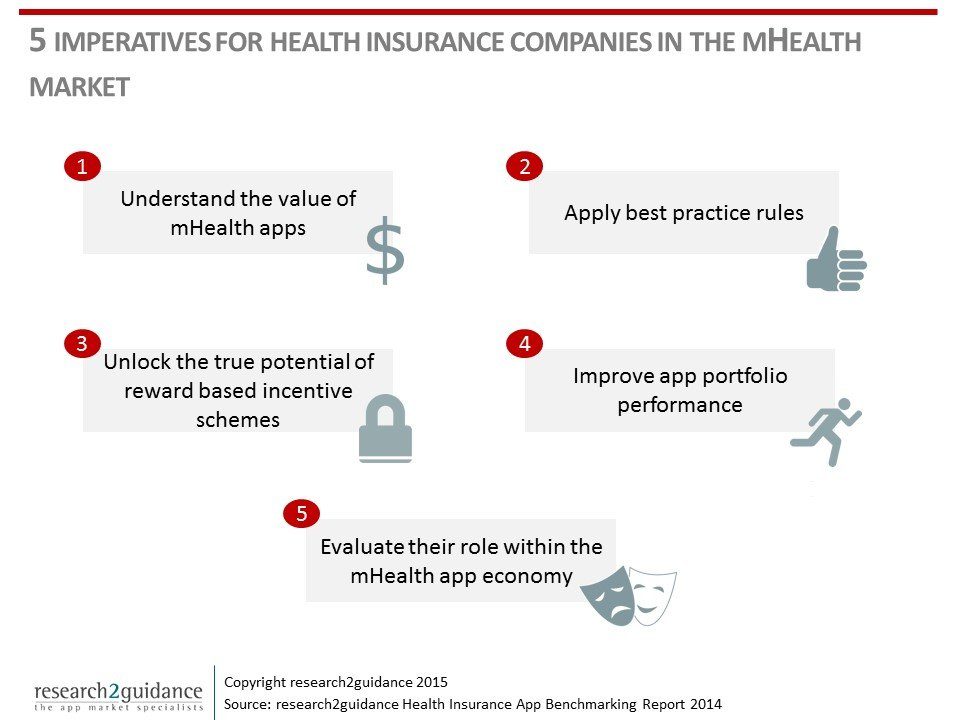

If HICs are to become successful they will have to formulate their mHealth app publishing strategy along 5 imperatives:

1. Understand the value of mHealth apps

mHealth apps could provide 5 economic advantages for HICs. These 5 main economical include reduced reimbursement payouts, retaining customers, acquiring new customers, generating new revenue streams and saving costs through efficiency gains.

2. Apply best practice rules

One of the main reasons why HICs are not able to leverage their significant in the traditional healthcare market into a market leader position in the mHealth app is that their app portfolio does not meet best practice elements users currently expect from mHealth apps. HICs, if they are to be more successful, must identify and incorporate elements of best practice and publish mHealth apps that are state-of-the-art.

3. Unlock the potential of reward-based incentive schemes

HICs are in a unique positions to link financial rewards via incentive schemes to health and cost saving behavior of their members. Financial benefits are a proven incentive to support behavior change. However, currently there are only a few HICs that link healthy behavior to financial rewards with the help of an app.

4. Improve app portfolio performance

The majority of mHealth apps belong to the ‘long-tail’ of apps that do not generate enough downloads or users. Based on the current performance of the HICs’ mHealth app portfolio, the chances of having a top ranked mHealth app in one of the two major app stores is less than 5%. Therefore HICs must improve the mHealth app portfolio performance if they are too succeed.

5. Evaluate their role within the mHealth app economy

There are systemic issues preventing HICs from achieving their economic goals via mHealth app publishing, with great scope for improvement. This being said there are 4 roles which HICs can adopt, other than as an mHealth app publisher if they are to be successful in the mHealth market. For example HICs could invest more in those mHealth apps that are best practice and that compliment and advance their service offerings.

If HICs do not rethink their approach to mHealth app publishing, they are likely to remain an industry player with a low impact on the mHealth app market. Continuing in this fashion is not currently a serious threat to HICs’ core business. But in the next 5 years it will be.

These are just some of the findings from our report, for a more detailed analysis of some of the world’s top health insurance companies and their mHealth app publishing activities check out our new 2015 Health Insurance App Benchmarking report.

Comments are as always welcome.

The mHealth Economics 2017 Report is out.

Download the report for free!